Specialist finance for commercial solar.

Our partners

The Right Finance For The Right Scheme

Based in the East of England we are an experienced team of financial, IT and solar experts using technology to develop cost-effective and efficient financing for solar PV and other renewable energy projects for companies across the UK.

We help to secure grants and work with borrowers to arrange finance, or lend ourselves, using an efficient process.

“We find great solutions for businesses by understanding their environmental and financial objectives.”

Richard Bartlett CEO

Our Products

GreenHearth fully funds systems costing £25k to £250k but can arrange up to £3m for a single company. Our products generally have terms from 5 to 15 years.

We are not linked to any one lender so we can always deliver a competitive rates and terms for you.

Our process and costs are transparent.

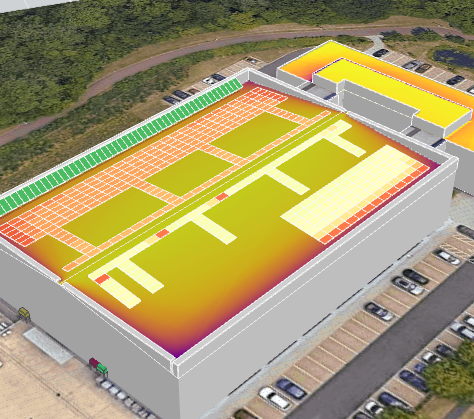

We offer 12 months monitoring using a “digital twin” for all new systems to track environmental and commercial outcomes for you.

Our proprietary software evaluates your energy and installation needs in order to offer the optimum finance solution; the right finance for the right scheme! By understanding and analysing your system requirements in depth, enables us to secure competitive lending terms that reflect the economic and environmental value of the system you install.

We act as both a broker and a lender. The loans we arrange are from a range of leading loan providers including our own lending team at GreenHearth Capital.

Our Software

Value of projects analysed:

£26,581,666

What our clients think

“The GreenHearth team gave us confidence that we had the right equipment, design and supplier. They took the stress out of the whole process. We reduced our borrowing requirement by winning a grant from the district council and GreenHearth delivered a great deal on a loan to fund the rest of the project.”

Alastair Ward - MD Elm Valley Foods

“… the team at GreenHearth played a vital role in our latest investment into solar PV. Their excellent optimisation study shows in a clear and concise way the detail that we needed to make an informed decision and will prove a valuable tool for us to use as the scheme generates power.”

Mathew Jewers - MD Jewers Grain

Why work with us?

We find you good financing deals by ensuring lenders have confidence in the design, components, installation and outcomes.

We understand the equipment we are financing and work with you to make sure that you are getting appropriate high quality systems.

We have access to a wide range of lenders who understand the value of solar and offer competitive rates and terms.

We offer ongoing monitoring of system performance with a “digital twin” for each project.

We use digital tools to support you through both the grant and loan application processes.

We use the digital twin to track outcomes and rapidly identify issues as they occur during operation.

FAQ’s

What grants are available to fund commercial solar systems?

The government has made almost £5 billion available to support businesses transition to Net Zero. This funding is distributed through a complex web of organisations and local government bodies. Each one has a slightly different application processes and eligibility requirements. The grants that may be available to you will depend on your location and the exact nature of your project. Our experience suggests that the best place to start is by looking at your local county or district council websites.

You can link to our Guide to Grants for Commercial Solar Systems for a review of the types of grants currently available around the UK.

What are the financing options for commercial solar systems?

The capital costs of a commercial solar system can be funded from:

a business’s own resources or existing borrowing lines;

grants from government schemes; or

by third parties.

Grants are usually for a maximum of 50% of the total cost.

Third party funding falls into three general categories:

Hire purchase agreements where the risks of system selection, system performance and power generated are held by the business installing the system;

Lease structures where the financier takes some element of the risks of system selection and performance; or

Power Purchase Agreements where the financier designs, installs and owns the system taking all of the risks associated with this process. In this case the business will undertake to buy a minimum amount of energy each year at an agreed price.

You can link to our Guide to Financing Commercial Solar for a review of the different approaches to financing commercial solar.

What is the typical payback time for a commercial solar system?

Our experience suggests that in the UK systems for commercial premises without batteries pay back the capital needed to install them in three to six years. The actual payback time for a commercial solar system will depend on the size, location and orientation of the system which all affect the amount of energy generated. It will also depend on the amount of energy used on site and importantly the daily profile of energy use. Solar systems generate energy during the day if the business uses most of its energy during the day payback periods will be quicker.

How does a commercial solar system work?

Commercial solar systems use energy from sunlight falling on the roof of commercial properties or land owned by the business to generate electricity. This is done using solar panels which convert sunlight into direct current electricity. This electricity is high voltage low current and transmitted along “strings” of connected panels to an inverter which converts the direct current electricity to alternating current at the grid voltage. The AC electricity is then used by the business with any excess power fed back to the grid.

Unlike domestic systems commercial systems in the UK tend not to have their batteries as the bulk of electricity usage by the business is during the day when the panels are generating power. However, it may make sense to add batteries if the daily profile of power consumption by the business is particularly flat.

What tax relief is available for companies installing a solar system?

The tax benefits that will be available will depend on how the system is financed and the specific situation of the company. We are not qualified to give tax or accounting advice, but here are some general points to consider:

Businesses usually record the solar system as an asset on their accounts and depreciate it over 20 to 25 years.

Businesses may also be eligible for Capital Allowances, which allows them to deduct some or all of the cost of the system from taxable income. There are three Capital Allowance regimes that are relevant for systems installed in the UK.

Annual Investment Allowance (AIA): This allows you to claim 100% of the cost of the system up to £1m in the first year, as long as you have not used this allowance for other qualifying investments.

Temporary Special Rate Allowance: This applies if you invest in a solar system before 01/04/2026 and you have already used your AIA. It lets you claim 50% of the cost of the system in the first year, and then 6% per year for the remaining cost.

Special Rate Expenditure: This is the default option if you do not qualify for the AIA or the Temporary Special Rate Allowance. It lets you claim 6% of the cost of the system per year.

If a business uses an operating lease or a Power Purchase Agreement to fund the system, it will not own the asset and generally cannot claim Capital Allowances. Instead, it will pay a regular fee for the use of the system, which is treated as an operating expense.

You can link to our Guide to Tax and Accounting for Commercial Solar for a review of tax and accounting of commercial solar systems.

Where do I start and how do I make the right decision?

The first questions to think about is what are you trying to achieve. Do you want to maximise value over 20 years? Get the most savings in year 1 or maximise the environmental impact of the scheme? Once you have an idea of what your objectives are the next step is to understand your current energy use.

You can link to our Guide to Procuring Commercial Solar for a detailed description of this process or get in touch and one of the team will be happy to help you out!